If you are on this post you must be familiar with mutual funds. Lerts now understand what Net Asset Value is and how it is calculated.

Table of Contents

1. What is Net Asset Value(NAV)?

2. What is the formula to calculate Net Asset Value?

3. Types of Net Value of an Asset calculated?

4. How can NAV be useful to you as an investor?

5. NAV role in the Funds Performance

6. Conclusion

What is Net Asset Value (NAV)?

Net asset value (NAV) depicts the market value per share for a particular Mutual Fund. NAV is calculated by subtracting all the liabilities from total assets and then dividing them by the total number of outstanding shares. If one has to determine the price of each mutual fund unit, then one would need to gather the market value of a portfolio and then divide it by the total current mutual fund unit.

Usually, the unit cost of a mutual fund begins with rs.10 and it would eventually grow, with the growth of assets under the fund. That is why popular funds have a higher Net Asset Value. It is mostly used in the case of open-ended funds. These shares do not get traded between shareholders, it would just help to determine the value of the mutual fund.

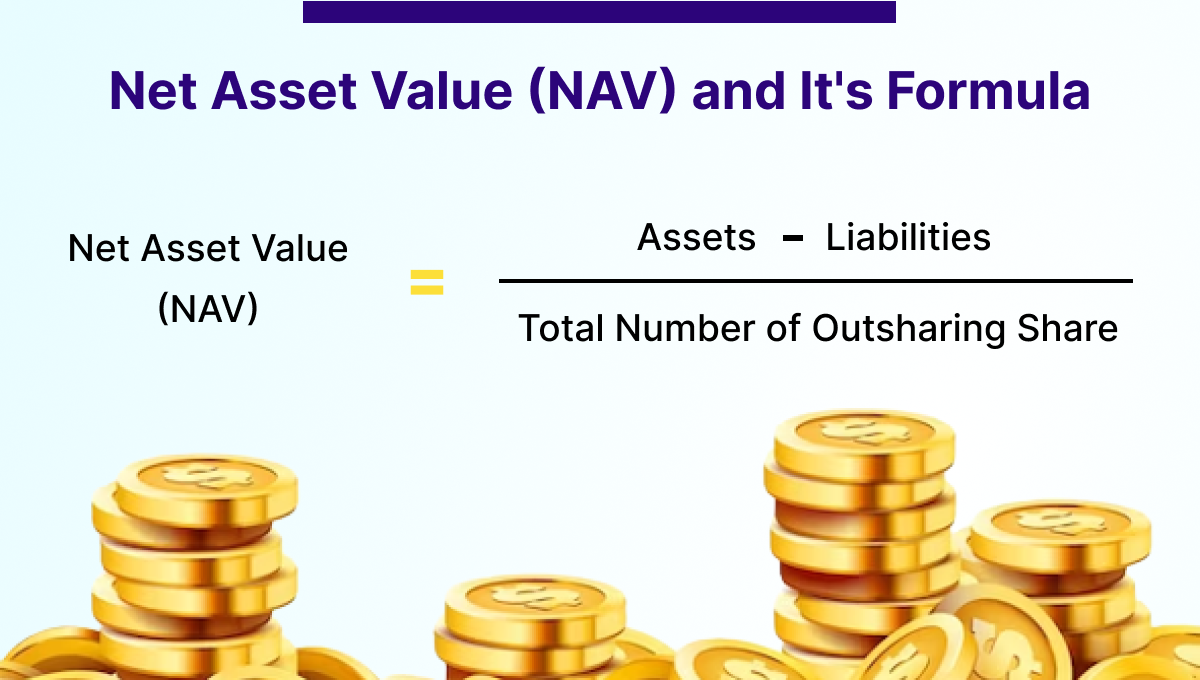

What is the formula to Calculate Net Asset Value?

There is a very easy formula to calculate NAV-

NAV= (total asset – total liabilities)/ total outstanding shares

To get the correct value of Net Asset Value input the values in the given fields.

Types of Net Value of an Asset calculated?

1. Daily net valuation of assets-

At 3:30 when the stock market closes, all the mutual fund companies evaluate the total worth of their portfolio. The mutual fund houses deduct all the expenses at the end of the day, to get the net value of assets.

2. General net calculation of the net value of assets-

The general net value of an asset is the price of its share. This calculation gives an estimated market value of a particular asset and can change with market fluctuations.

How can NAV be useful to you as an investor?

Net Asset Value is not what you think, it doesn’t determine the value of each share, which most investors assume it to be. Net Asset Value helps you understand the total monetary worth of assets of the company, while in other documents you just come across liquid assets, it’s just a good way to make your investment decisions.

The Equity represents working capital of the company and the monetary worth is represented by NAV.

NAV role in the Funds Performance

A lot of investors think that the low price of a fund means it is cheaper and it is the right fund to invest but the net asset value does not represent the actual value of the mutual fund. It represents the performance of the mutual fund in the last few years.

Investors should not make NAV as the only parameter while choosing a good fund to invest. Investors should check all parameters before investing in any mutual fund.

Therefore Net Asset Value is used to represent the performance of the fund each and every day. Investors should choose the past years performance and price of the mutual fund before investing in any mutual fund.

Conclusion

NAV can be a good factor while making your decisions, but it doesn’t matter that much, but would help you understand the assets and liabilities of a company. It is a good indicator for the daily performance of the mutual fund.